Highlights of Union Budget 2021-22

NEW DELHI:

Finance Minister Nirmala Sitharaman on Monday, February 1 presented the union budget 2021-22 in the Lok Sabha.

Here are the highlights of the Union Budget:

Fiscal position and health outlay:

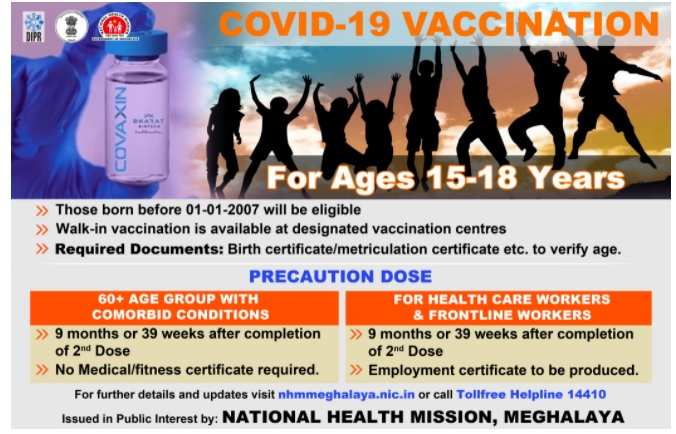

* Spending on healthcare hiked by 137 per cent to over Rs 2.23 lakh crore

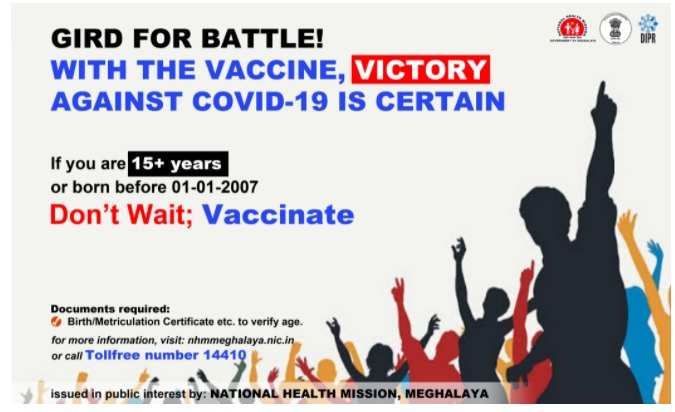

* Rs 35,000 crore outlay for COVID vaccine in fiscal beginning April 1

* Today India has two vaccines available - Covaxin and Covidshield; two more vaccines are expected soon

* Sharp increase in capital expenditure for next fiscal to Rs 5.54 lakh crore up from Rs 4.39 lakh crore of last fiscal

* Fiscal deficit for current fiscal at 9.5 per cent, against 3.5 per cent budgeted

* Fiscal deficit for next fiscal pegged at 6.8 per cent, government to borrow Rs 12 lakh crore

* Committed to bringing down fiscal deficit below 4.5 per cent of Gross Domestic Product (GDP) by 2025-26

Tax Proposals

* Income Tax Return (ITR) filing not mandatory for senior citizens above 75 years, banks to deduct Tax Deducting at Source (TDS)

* Time bar for reopening I-T assessment cases halved to 3 years; for serious frauds, it is 10 years

* Income tax return filers increased to 6.48 crore in 2020 from 3.31 crore in 2014

* Agri infra cess of 2.5 per cent on gold, silver and dore (semi-pure alloy of gold and silver) bars; 35 per cent on apples

* Agri infra cess of 30 per cent on Kabuli chana, 10 per cent on peas, 50 per cent on Bengal gram/chickpeas, 20 per cent on lentil (mosur); 5 per cent on cotton

* Rs 2.5 per litre agri infra cess on petrol, Rs 4 on diesel (HIGHLIGHT)

* New Agri Infra Development Cess to be applicable from February 2

* Tax department to notify rules to remove hardships of double taxation faced by NRIs

* Tax holiday for startups, capital gains exemption extended by 1 year

* Tax exemption for aircraft leasing cos

* Tax exemption for notified affordable housing for migrant workers.

* Rs 1.5 lakh tax deduction on payment of interest for affordable housing extended by 1 year

* Exemption from tax audit limit doubled to Rs 10 crore turnover for companies doing most of their business through digital modes

* Proposes review of over 400 customs duty exemptions; to begin extensive consultation from October 2021

* Customs duty on certain auto parts, solar equipment raised

Allocation and reforms:

* FDI in insurance increased to 74 per cent from 49 per cent

* Disinvestment target pegged at Rs 1.75 lakh crore

* BPCL, IDBI Bank, two more PSU banks, one insurance company to be privatised among others

* PSU Bank recapitalisation pegged at Rs 20,000 crore next fiscal

* Aatmanirbhar health programme with an outlay of Rs 64,180 crore to be introduced

* Budget proposals rest on six pillars-- health and well-being, physical and financial capital and infra, inclusive development for aspirational India, human capital, innovation and Research and Development (R&D), Minimum Governance and Maximum Governance

* Govt to introduce a bill to set up development financial institution with an outlay of Rs 20,000 crore

* Voluntary vehicle scrapping policy to phase out old vehicles; fitness tests after 20 yrs for personal vehicles

* National monetisation pipeline for potential brownfield infrastructure assets

* Rs 3,726 crore for forthcoming Census which will be the first digital census.

(PTI)

ALSO READ

Also Read: Capital expenditure hiked 34.5% to Rs 5.54 lakh cr in FY'22 to push growth